TL;DR

The creator economy is on a trajectory to reshape the digital landscape, with the web3 space pioneering a revolution. Projections suggest that by 2027, this burgeoning sector could be worth half a trillion dollars. This growth mirrors the seismic shift towards a digitized global job market, with a burgeoning number of individuals carving out niches in online communities.

Central to this movement are web3 platforms such as OpenSea, Foundation, and Zora, which provide a decentralized stage for creators ranging from digital artists to decentralized application developers.

As the web3 creator economy flourishes, the mechanisms for compensation are evolving. The traditional model of bi-weekly salaries is becoming obsolete, making way for a more dynamic system of value exchange, particularly one that aligns with the decentralized and flexible ethos of web3. Smart contracts and blockchain technology are at the forefront of this shift, offering automated, secure, and immediate transactions.

Creators in web3 are diverse in their output and their payment preferences. While some may prefer the novelty of crypto, others might opt for the stability of fiat currencies.

Recognizing this, companies should embrace payment platforms that offer the flexibility of payouts in both cryptocurrency and fiat, ensuring they cater to the individual needs of each creator. This is not merely a courtesy but a strategic advantage in attracting the most innovative talents in the web3 domain.

Navigating the intricacies of mass payouts in the web3 space can be complex. Companies engaging with a multitude of creators must tackle the challenge of scaling their payment systems to handle a high volume of transactions, possibly in various cryptocurrencies and fiat currencies. This complexity is compounded by the need to adhere to diverse regulatory frameworks, each with its tax implications and legal standards.

Web3 Creator Platforms

The creator economy in Web3 revolves around platforms that leverage blockchain technology to empower creators with more control over their content and a fairer distribution of revenue. Here are some examples of creator economy platforms in Web3:

NFT Marketplaces:

- OpenSea: A decentralized marketplace for buying, selling, and discovering rare digital items and collectibles.

- Rarible: A creator-centric NFT marketplace that allows artists and creators to issue and sell custom crypto assets that represent ownership in their digital work.

- Foundation: A platform that aims to bring digital creators, crypto natives, and collectors together to move culture forward.

Social Tokens Platforms:

- Roll: Provides infrastructure for creators to mint and distribute their own social tokens.

- Rally: An open network that enables creators to launch vibrant and independent economies with their communities powered by the ethereum blockchain.

Decentralized Publishing / Blogging Platforms:

- Mirror: A decentralized blogging platform that features a range of tools for writers and creators to publish content, run crowdfunding campaigns, and create NFTs.

- Steemit: A blockchain-based blogging and social media website that rewards users with the cryptocurrency STEEM for publishing and curating content.

Decentralized Video Platforms:

- Livepeer: A decentralized video streaming network built on the Ethereum blockchain.

- Theta Network: A decentralized video delivery network, powered by users and an innovative new blockchain.

Music and Audio Platforms:

- Audius: A music streaming and sharing platform that puts power back into the hands of content creators.

- Catalog: Works like a record label for the digital age, built on the Ethereum blockchain.

Decentralized Content Management Systems:

- Aragon: A project that aims to disintermediate the creation and maintenance of organizational structures by using blockchain technology.

- Graph Protocol: A protocol for indexing and querying blockchain data that enables creators to build various APIs and applications easily.

Gaming and Virtual Worlds:

- Decentraland: A virtual world where users can own and monetize plots of land and other in-game assets.

- Sandbox: A community-driven platform where creators can monetize voxel assets and gaming experiences on the blockchain.

Fan Engagement Platforms:

- Patreon: While not entirely on the blockchain, it's exploring ways to incorporate Web3 technologies to give creators more ownership and engagement with their fans.

- OnlyFans: Also primarily a Web2 platform, it is looking into blockchain technology to add new features and offer more to its creators.

Creator DAOs (Decentralized Autonomous Organizations):

- Friends With Benefits: A social DAO that offers a community for creators and artists.

- Whale: A social currency that is backed by one of the world's largest collections of high-value NFTs.

Where Flexible Payments Meet Platform

To mitigate risks and streamline operations, companies must employ payment platforms designed for the web3 economy. These platforms should not only handle the currency conversions between crypto and fiat efficiently but also minimize the erosion of value through high fees or unfavorable exchange rates. Traditional money transfer services, while familiar, may not offer the agility or cost-effectiveness necessary for the fast-paced and global nature of web3 transactions.

The right payment platform is one that integrates seamlessly with the decentralized finance (DeFi) sector and traditional finance (TradFi), offering robust compliance layers that address KYC and AML standards, and provide flexibility in payout options.

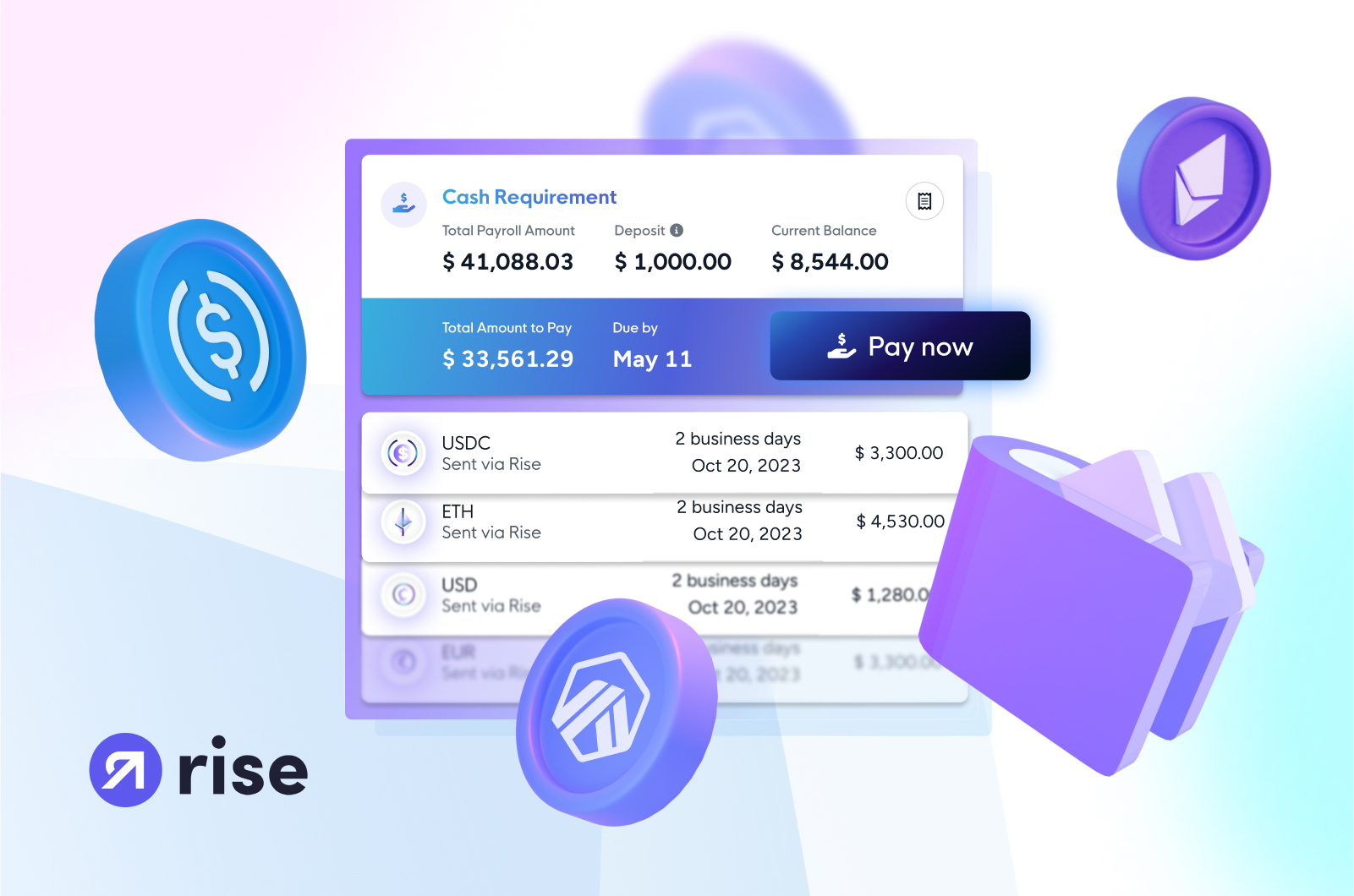

An emerging leader in this space is Rise, which exemplifies the convergence of comprehensive payroll solutions with web3 capabilities. Rise streamlinks the hiring and payment process, offering identity verification, professional service agreements, and flexible mass payouts in both fiat and cryptocurrencies.

In this rapidly evolving landscape, creators value choice and control over their earnings. Platforms that provide a gateway to both the DeFi and TradFi ecosystems empower creators to manage their finances on their terms. As creators enjoy greater freedom in choosing their projects and defining their work schedules, it's imperative that this flexibility extends to how and when they receive compensation.

The Diverse Preferences of Creators

Depending on the field in which a creator specializes, compensation preferences are likely to vary. The best way to determine how a creator wants to receive their paycheck is, of course, by asking them point blank. Before making the assumption that all digital creators want payment in crypto or fiat, it's important to have a variety of options available. While NFT artists may want tokenized compensation, designers and writers in the web3 space may want the option to receive fiat payouts.

The employment flexibility that online, remote, and contracting work offers to individuals has led to an increased demand for comparable flexibility in remuneration. It has become a popular ask to have the option to receive full or partial wages in crypto. While this is a long-standing practice in the web3 world, it has also now trickled into the traditional workforce.

For companies, by coming to the negotiating table with options for fiat, stablecoin, and crypto payouts already available, a competitive edge is gained in attracting top creators. Furthermore, onboarding with a solution that automates flexible mass payouts across currencies allows for additional streamlining of the payroll process.

The Challenges of Issuing Mass Payouts

Depending on the number of independent creators a company is contracting at a given time, complications with streamlining mass payouts can arise. If creators are relatively few, payment issuance is simple. Finding solutions to achieve mass payouts at scale is thus a top priority for companies who cater to or contract out significant swaths of work. The most straightforward way to achieve this is by onboarding payroll with a provider who specializes in global mass payouts.

Alongside the logistical legwork of scaling mass payouts, the importance of ensuring full adherence to regulatory requirements and legal standards cannot be overlooked. This is especially relevant and poses increased risk potential for companies working with a widely distributed network of international creators. Due to varying tax and employment regulations across the globe, a company must be able to ensure that their payments are fully compliant with the standards of each jurisdiction in which they are issued.

Piggybacking on the compliance challenges that can accompany global contracting is the hurdle of currency conversion and its associated fees. As was stated earlier, the ability to offer a wide range of payout options to creators is a major incentive. While a creator in the US may require payments in dollars, their UK counterparts will most likely want payouts in GBP. If a company’s treasury is held in crypto, figuring out a system for routing between fiat and crypto, while skirting high currency conversion fees is crucial.

Traditional systems for wiring money often come with prohibitively high exchange rates and conversion fees, resulting in the loss of one third of transacted funds. Identifying a solution built specifically for international payments is the best way to avoid this issue.

Choosing the Right Payment Platform

The majority of obstacles that arise when issuing mass global payouts can be solved by onboarding with a versatile and flexible payroll solution. In the search for a best-fit product, it's important to look out for which ones offer a wide range of supported currencies, advanced security technology, and low fees.

When looking at PayPal, for example, one of the market leaders in international payments, when sending money to an international account not only is a domestic fee applied, but an additional 5% international fee and surcharge. Despite the many convenience factors that PayPal boasts, it is slower than other money transfer options, taking up to five days for funds to be delivered.

With Wise, which like PayPal is structured to streamline international payments, while sometimes wages arrive in seconds, other times they can take days. Additionally, Wise continues to raise its international fees. After a fee increase for international USD transfers in September of 2023, depending on the country to which payment is being sent, associated fees can reach almost $35.

While both PayPal and Wise make sending payments in one, easy click possible, their high fees and slow delivery rates lower their appeal. Additionally, rather than serving as comprehensive payroll and compliance platforms, their functions are much more limited.

A notable feature to look out for when selecting a payment platform is ensuring that it has a robust compliance layer. Regardless of the currency in which payments are being sent- whether fiat, crypto, or stablecoins- making certain that all KYC and AML requirements are met is imperative with an added bonus if there are compliant onboarding services as well. If a platform does not offer KYC and AML services, the potential noncompliance risks are high.

Empowering Creators with Choice

The importance of prioritizing creator’s’ needs cannot be overstated. Attempting to attract top talent while offering limited compensation options that do not match contemporary demands will quickly lead to failure. Thus, an easy step for keeping pace with the quickly-evolving creator economy is onboarding with a modern, comprehensive payroll solution.

In a survey of available products, Rise stands out from the competition due to its unmatched flexibility. Rise is an all-in-one payroll and compliance solution that streamlines the hiring process and unlocks flexible, mass payouts in fiat and crypto. Through the Rise Pay platform, companies can verify identity and compliance through KYC checks, generate professional service agreements close-to instantly, and set up one-click mass payouts. With Rise, a company can fund payroll from a traditional bank account or a digital wallet, in fiat or USDC, and Rise’s routing infrastructure issues payments in USD to ensure full compliance. Once received, a creator has the option to withdraw their earnings across a selection of 90 fiat currencies and 100 cryptos.

Opting for an all-in-one solution that processes hiring and payroll as well as routing and currency exchange brings next-level convenience to a company, and financial empowerment to creators. The ability to tap into various financial ecosystems, from DeFi to TradFi, allows for creators to wield more control over their earnings. As creators and freelancers experience a general increase in flexibility with regards to working hours and project selection, it is only natural for that sentiment and practice to carry over to remuneration.

The Future of Mass Payouts in the Creator Economy

Automation in the realm of payroll has already shown its potential to reduce processing costs by up to 80%. On the heels of other automation trends, automated mass payouts hold the promise of enhanced convenience and increased cost efficiency. As the creator economy continues to expand, it can be predicted that payment platforms will keep evolving to accommodate the demands of creators. These changes will likely encompass a broader array of currency options for compensation, an emphasis on localized payments to accommodate creators in different regions, and more flexibility with payout scheduling to allow creators to get paid at their convenience.

Helping to accommodate these changes are highly-adaptable emerging technologies. In particular, blockchain technology has proven to be a leading force in the realms of payroll and compliance. Blockchain networks allow for the instant and low-cost transfer of funds across international borders and smart contracts bring a new level of agility to mass payouts. When leveraging smart contracts for creator compensation, as soon as certain criteria are met such as completing a project or reaching a payment threshold, the smart contract automatically initiates the payout.

Since smart contracts exist on blockchain networks, transactions are fully transparent to all parties involved. They bring an additional security layer to the payment process due to being tamper-resistant and lower the administrative costs associated with manual payment processing. It can be predicted that as smart contract technology becomes more robust and web3 infrastructure more widely adopted, these will become key players in compensation across all industries.

Adaptive Hiring and Embracing the Creator Economy

The future of mass payouts in the creator economy is intrinsically linked to the integration of automated solutions, which are set to further reduce processing costs and enhance convenience. Blockchain technology, with its capacity for instant, secure, and low-cost transfers, is already revolutionizing payroll and compliance. Smart contracts, in particular, are redefining mass payouts, triggering automatic payments upon the fulfillment of contract terms without the need for manual intervention.

Web3 is not just a technology but a new paradigm for the creator economy, where empowerment, autonomy, and flexibility are not just buzzwords but the foundation of the ecosystem. As companies adapt to this new world, the payment platforms they choose will be pivotal in shaping the creator economy's trajectory, ensuring that it remains as dynamic, inclusive, and innovative as the creators it serves.

-6Nov2023.jpg)