Ever wondered how to effortlessly integrate and expand your hybrid payroll payment capabilities?

This article unveils the secrets to automating and scaling your cryptocurrency and global fiat transactions, ensuring they're as simple and efficient as any conventional payment method.

Let's dive in.

Globally Accessible Payroll

The paradigm shift towards remote work catalyzed by the COVID19 pandemic has underscored the need for innovative approaches to global workforce compensation.

At present, there are relatively few payroll solutions that enable borderless payments with reduced fees and instant transactions, while simultaneously ensuring complete adherence to tax and labor regulations. An international wire transfer, for example, can average $44 and take up to five days to arrive.

The inefficient and cumbersome solutions of the past cannot scale to meet the needs of today's workforce.

For this reason, expanded options for payouts in crypto have captured the attention of global contractors and employees.

For one, transactions occurring on blockchains are significantly expedited, with networks such as Arbitrum averaging 15 seconds per block. Transaction fees are reduced as well, with lows of $0.368 per transfer. And perhaps most important with respect to the global workforce, transactions using blockchain technology are inherently borderless.

Mainstream Adoption and Wide-Ranging Applications of Crypto

In 2023, crypto continued to shed its reputation as being a fringe and risky currency. It had officially entered into the mainstream with 90% of central banks worldwide now beginning the process of experimenting with or investigating some form of a central bank digital currency.

This marks a significant turning point in the global adoption of blockchain technologies and their applications across diverse industries.

In tandem, stablecoins have seen explosive growth over the last few years. In 2021, USD-pegged stablecoins alone reached a circulating supply of $130 billion, which marked an increase of more than 500 percent from the previous year.

With usage rates steadily on the rise, the response of governments across the globe has been on the whole a positive one. A new wave of regulation has ushered in with it more opportunities for crypto’s integration into daily life.

From payment in crypto for goods and services to mass donations in crypto for humanitarian needs in Ukraine, favorable policies have allowed for crypto’s utility to be experienced on a broader scale.

In countries such as Hong Kong, regulatory infrastructure has been implemented to encourage the development of the crypto industry and to attract global blockchain-based companies. This future-facing approach is sure to prove advantageous to both corporate and governmental entities with the crypto market anticipated to experience a compound annual growth rate of 56.4% between 2019 and 2025.

Utilizing Smart Contracts for Payment Triggers

Smart contracts offer an inherently reliable mechanism for automating and executing payroll obligations in the crypto realm.

- Automate payment releases upon the completion of predefined milestones or work hours.

- Enable real-time, transparent auditing trails for both payer and payee.

- Guarantee the execution of payments under the strict conditions set forth in the contract.

- Minimize the risk of late or missed payments through decentralized execution.

Smart contracts remove the necessity for intermediary oversight, streamlining the payout process efficiently.

Codifying payroll terms into smart contracts ensures payment accuracy and on-time delivery, fostering trust in decentralized finance arrangements.

Crypto, Automation, and Payroll

A buzzword gaining equal traction to ‘crypto’ as it relates to payroll trends is ‘automation’.

According to research conducted by PayrollOrg, automation can reduce payroll costs by an estimated 80%.

Automating payroll is an essential practice for businesses across all industries as it streamlines the complex process of compensating employees while reducing the risk of costly errors and compliance issues.

With automation comes the freeing up of valuable time and resources that can be redirected toward strategic activities that foster overall business growth and productivity.

For companies that want to attract and retain top global talent, it is critical to integrate systems for automating fiat and crypto payments.

Through offering the flexibility of remuneration across a wide range of currencies while ensuring that all payouts are received in a timely manner, companies can enhance the appeal of their compensation packages.

When working with dispersed, global teams, a first step in choosing a payroll solution is investigating how extensive the currency offerings are.

While many Millenial and Gen Z workers would happily opt to receive their payments in crypto, it is important to also provide options for fiat compensation.

By identifying a platform that provides comprehensive payroll services in fiat and crypto, robust automation capabilities, and ensures local and global tax compliance, organizations can achieve seamless scalability for their global teams.

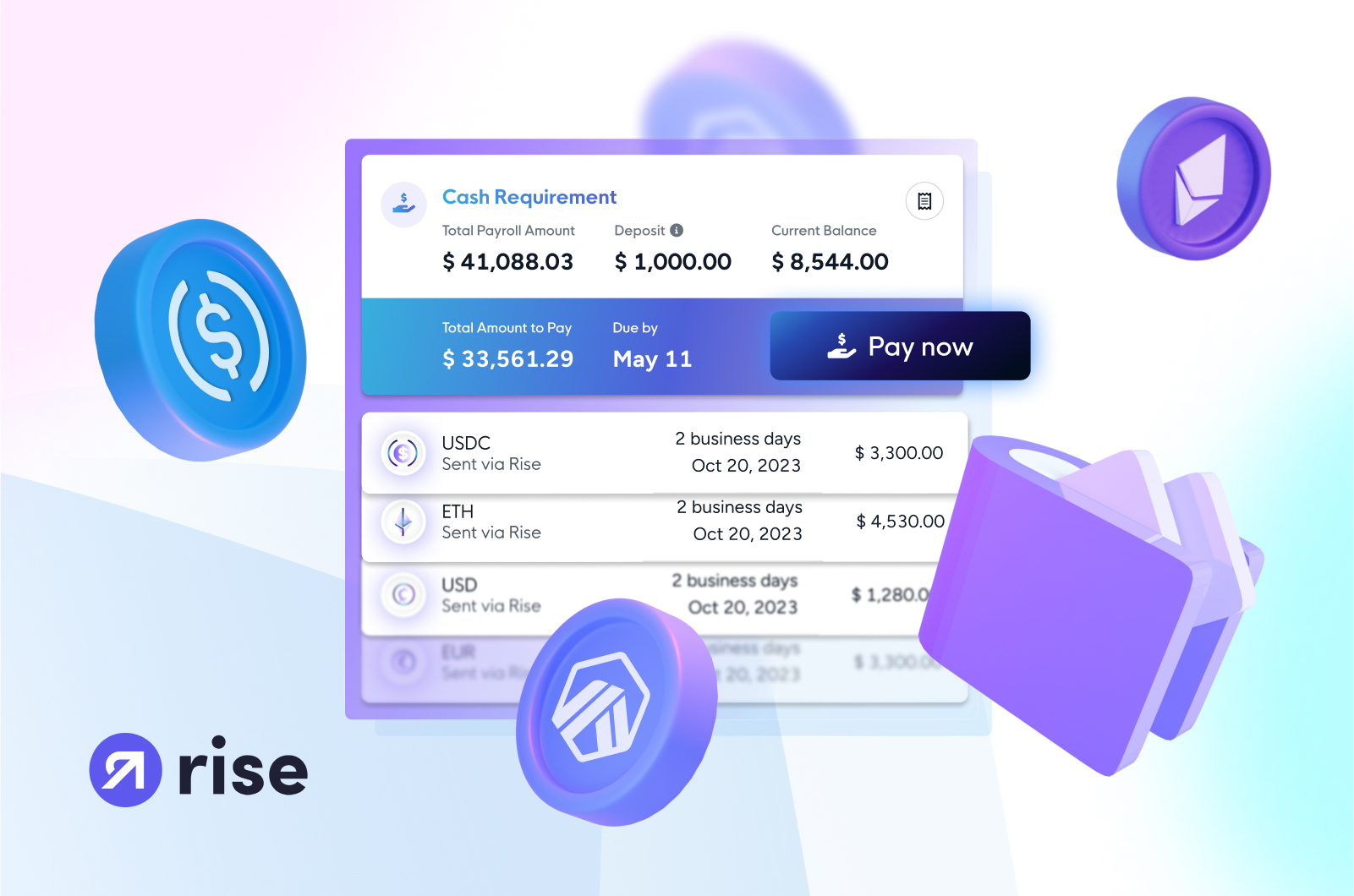

How to Automate Fiat and Crypto Payroll with Rise

Rise is an all-in-one payroll and compliance solution that introduces essential automation elements to HR processes. Built for traditional companies and web3-native organizations alike, Rise is an expert in local tax compliance worldwide, ensuring that payroll adheres to all regulations regardless of the country or currency in which it is being issued.

1. Create a Business Account

Visit the Riseworks.io and sign up for a business account by providing basic company information, such as your business name, address, and contact details.

After registration, you'll be prompted to complete a verification process to ensure the security and legality of your account, which may involve submitting additional documents or information about your business.

2. Invite and Onboard Your Contractors Compliantly

Next, you’ll invite your contractors to join the Rise platform simply by sending them an email.

From there, your contractors will be onboarded quickly and compliantly by going through KYC checks and identity verification.

They will be given a unique Rise ID, a digital wallet address, and will be able to set up their preferred payment methods for withdrawals.

3. Fund Your Payroll

Rise gives employers the unique ability to fund payroll in either US dollars or USDC stablecoin, so that global employers are not limited by traditional banking systems.

If you choose to fund in USDC, you can use any of our integration partners including Arbitrum, Coinbase, Uniswap, Ethereum, Metamask, Avalanche, Gnosis Safe, Optimism, Polygon, MEW, and Torus.

Once the funds are available, you can easily allocate them to your payroll needs within the Rise platform, setting up automated payments in either fiat or cryptocurrency according to your payroll setup.

4. Set Up Payment Schedules

Within the Rise platform, you can establish payment schedules that fit your business operations, whether that's weekly, bi-weekly, monthly, or custom intervals.

This flexibility allows you to align payroll disbursements with your company's cash flow and contractor expectations.

Moreover, Rise offers the capability to automate these payments, ensuring that your contractors receive their earnings on time, every time, without manual intervention, thus reducing administrative workload and enhancing payment accuracy.

5. Contractors Withdraw in Their Preferred Currency (Fiat or Crypto)

Contractors have the freedom to withdraw their earnings in their preferred currency, whether it's fiat or a variety of cryptocurrencies, directly from their Rise digital wallet.

This feature supports the diverse needs of a global workforce, enabling seamless conversion and transfer of funds to their personal accounts without the need for intermediaries.

Get Started Today

Experience the ease and efficiency of automation with Rise.

Schedule a demo today to learn more about how Rise can streamline your payroll and hiring across more than 150 countries.