We just launched our new brand. Check it out and see how we are changing the Remote Payment HR world forever.

Weekly payroll

This is a common payroll frequency in industries where employees work hourly or on a shift basis, and it helps ensure regular cash flow for workers.

Key Elements of Weekly Payroll

- Payment Frequency: Wages are processed and paid every seven days, typically for work completed in the previous week.

- Time Tracking: Accurate tracking of hours worked is crucial to ensure correct payment, particularly in industries where hours vary week by week.

- Tax Withholding: Employers must deduct and report taxes weekly based on federal, state, and local regulations.

- Payroll Processing: Regular calculation of wages, deductions, and benefits for employees is a key aspect of the weekly payroll system, ensuring timely distribution of funds.

- Compliance with Labor Laws: Employers must ensure they adhere to wage and hour laws when processing weekly payroll. A weekly payroll schedule is important in ensuring compliance with labor laws.

Understanding Pay Periods

A pay period is a specific duration of time during which employees earn wages that will be paid to them on their next paycheck.

It is a critical component of payroll management, as it determines when employees will receive their pay and how often payroll will be processed.

Understanding pay periods is essential for businesses to ensure compliance with labor laws and regulations, as well as to maintain a smooth and efficient payroll process.

Pay periods can vary in length, and the choice of pay period can impact both the employer and the employee.

For businesses, selecting the appropriate pay period helps in managing cash flow, planning payroll schedules, and ensuring timely payment of wages.

For employees, the pay period affects how frequently they receive their earnings, which can influence their financial planning and stability.

Types of Pay Periods

There are several types of pay periods that businesses can use, each with its own set of advantages and disadvantages:

- Weekly Pay Periods: Employees are paid every week, typically on the same day of the week. This type of pay period is common in industries with hourly employees, as it aligns well with variable work schedules and provides frequent cash flow for workers.

- Biweekly Pay Periods: Employees are paid every two weeks, typically on the same day of the week. This pay period reduces the administrative workload compared to weekly pay periods while still offering relatively frequent payments.

- Monthly Pay Periods: Employees are paid once a month, typically on the same day of the month. Monthly pay periods are less common for hourly employees but are often used for salaried employees with a stable annual salary.

- Semimonthly Pay Periods: Employees are paid twice a month, typically on the 1st and 15th of the month. This pay period provides a balance between the frequency of payments and administrative efficiency.

- Annual Salary Pay Periods: Employees are paid an annual salary, which is divided into equal payments throughout the year. This type of pay period is typically used for salaried employees with a fixed annual salary.

Each type of pay period has its own benefits and challenges.

Businesses should carefully consider their specific needs and the preferences of their employees when choosing the most suitable pay period.

Why Is Weekly Payroll Important?

Weekly payroll provides several advantages for both employees and businesses:

- Timely Payments: Employees receive their earnings quickly through weekly paychecks, helping them manage personal expenses more easily.

- Increased Worker Satisfaction: Workers tend to appreciate the frequent pay schedule, leading to higher morale and loyalty, especially in industries with hourly workers.

- Reduced Financial Stress: Weekly payroll can help employees avoid the need for short-term loans or payday advances by providing consistent cash flow.

- Payroll Accuracy: Weekly payroll allows for more frequent checks of hours worked, making it easier to correct any discrepancies promptly.

Common Industries That Use Weekly Payroll for Hourly Employees

Certain industries prefer a weekly pay period due to the nature of the work and compensation structure.

These include:

- Hospitality: Restaurants, hotels, and other service-oriented businesses with hourly employees often use a weekly pay period to compensate for varying shifts.

- Retail: Retail companies that employ large numbers of part-time or seasonal workers may choose a weekly pay period to align payments with work schedules.

- Construction: Construction workers are often paid weekly based on hours worked or project completion.

- Healthcare: Healthcare workers on per diem or shift-based schedules may be paid on a weekly basis.

- Temp Agencies: Temporary staffing agencies frequently use a weekly pay period to compensate short-term workers.

Benefits of Weekly Payroll

1. Employee Satisfaction: Offering weekly payroll keeps workers financially secure, especially those in industries where wages are highly dependent on hours worked.

2. Flexibility: A weekly pay schedule is particularly advantageous in industries with variable hours, as it allows for adjustments based on weekly labor input, ensuring accurate and timely payments.

3. Faster Issue Resolution: Discrepancies in pay are more likely to be identified and corrected quickly, improving transparency and trust between employer and employee.

4. Streamlined Cash Flow for Workers: Employees can better manage their finances when paid frequently, reducing the need for loans or payday services.

Challenges of Weekly Payroll

While weekly payroll has its benefits, it also comes with challenges for employers:

- Increased Administrative Burden: Processing payroll every week requires more frequent calculations, documentation, and tax filings, which can increase administrative costs.

- Cash Flow Management: Businesses must ensure they have sufficient cash flow to meet payroll obligations every week. In contrast, a biweekly pay schedule can ease cash flow management, although it may present challenges during months with an extra paycheck.

- Compliance Complexity: Employers must adhere to tax and labor laws, making frequent payroll more complex in terms of compliance.

- Higher Costs: Companies may face higher costs associated with running payroll more frequently, especially if using third-party payroll services that charge by the run.

Weekly Payroll vs. Bi-Weekly Payroll

Weekly payroll pays employees every seven days, while bi-weekly payroll pays them every two weeks.

The key differences include:

- Payment Frequency: Weekly payroll has 52 pay periods per year, while bi-weekly payroll has 26.

- Cash Flow Impact: Weekly payroll requires more frequent cash flow management from businesses, whereas bi-weekly payroll spreads out payments.

- Administrative Workload: Weekly payroll requires more frequent processing, while bi-weekly payroll reduces the administrative burden slightly.

- Monthly Payroll: Monthly payroll pays employees once a month, which is often preferred by businesses with mostly salaried employees and regular working hours. It can be beneficial for managing payroll efficiently, especially for small businesses that frequently hire freelancers or independent contractors. However, it may not meet the expectations of employees who prefer more frequent payments.

Processing Payroll for Hourly Employees

Processing payroll for hourly employees requires careful attention to detail and accuracy, unless you use international payroll software like Rise.

Here are the steps involved in processing payroll for hourly employees:

- Gather Time Sheets: Collect time sheets from hourly employees, which should include the number of hours worked, the date, and the pay rate. Accurate time tracking is essential to ensure employees are paid correctly.

- Calculate Gross Pay: Calculate the gross pay for each employee by multiplying the number of hours worked by the pay rate. This step requires precision to avoid any discrepancies.

- Calculate Deductions: Calculate deductions such as taxes, insurance premiums, and retirement contributions. Payroll administrators must stay updated on current tax rates and regulations to ensure compliance.

- Calculate Net Pay: Calculate the net pay by subtracting deductions from the gross pay. This is the amount that will be transferred to the employee’s bank account or issued as a paycheck.

- Process Payroll: Process payroll by transferring the net pay to the employee’s bank account or by issuing a paycheck. Timely processing is crucial to maintain employee satisfaction and trust.

- Review and Reconcile: Review and reconcile payroll to ensure accuracy and compliance with labor laws and regulations. Regular audits can help identify and correct any errors promptly.

Payroll administrators should ensure that they are using the correct pay rate, calculating deductions accurately, and processing payroll in a timely manner to avoid errors and delays.

By following these steps, businesses can maintain an efficient and compliant payroll system for their hourly employees.

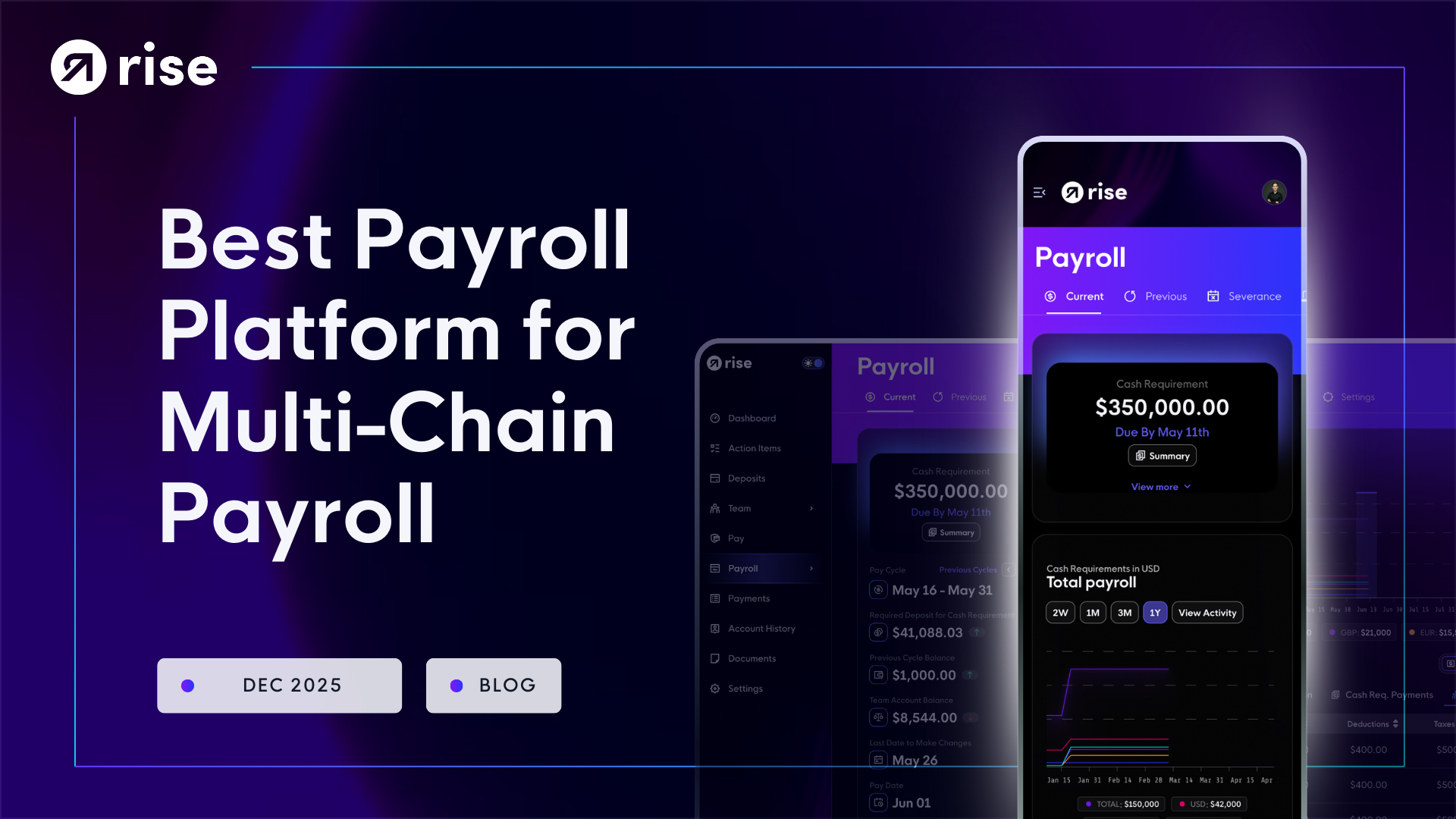

Best Weekly Payroll for Web3 Companies

Rise is undoubtedly the best weekly payroll solution for Web3 companies due to our innovative approach to payroll processing and its ability to seamlessly integrate with blockchain technology.

In the world of Web3, where decentralization and digital assets are key, Rise offers a payroll system that aligns perfectly with the unique needs of these companies.

1. Blockchain Integration: Rise leverages blockchain technology to provide secure and transparent payroll processing. This ensures that transactions are tamper-proof and auditable, which is essential for maintaining trust in decentralized environments.

2. Flexibility and Scalability: As Web3 companies often operate in dynamic and fast-paced environments, Rise offers the flexibility to adapt to changing payroll needs. Our scalable platform can handle the growing demands of Web3 businesses, whether they are startups or established enterprises.

3. Cryptocurrency Payments: With the rise of digital currencies, Rise supports crypto payroll, allowing Web3 companies to pay their employees in cryptocurrency. This feature is particularly attractive to employees who are part of the crypto ecosystem and prefer to receive their earnings in cryptocurrencies.

4. Automation and Efficiency: Rise automates the payroll process, reducing the administrative burden on payroll administrators and ensuring that employees are paid accurately and on time. This efficiency is crucial for Web3 companies that need to focus on innovation and growth.

5. Compliance and Security: Rise ensures compliance with tax regulations and labor laws, even in the complex landscape of digital assets. Our security measures protect sensitive payroll data, providing peace of mind to both employers and employees.

By choosing Rise, Web3 companies can streamline their payroll operations, enhance employee satisfaction with timely payments, and stay ahead in the competitive digital landscape.

Best Practices for Weekly Payroll Schedule

- Automate Payroll: Use software to handle payroll calculations and tax withholdings to reduce errors and save time.

- Accurate Time Tracking: Implement reliable time-tracking systems to ensure employees are paid correctly based on hours worked.

- Ensure Compliance: Stay up to date with labor laws and tax regulations that may affect your payroll processing.

- Cash Flow Planning: Ensure your business maintains the necessary cash reserves to meet weekly payroll obligations. For businesses using monthly payroll, this planning is crucial to manage cash flow efficiently, especially for small businesses that hire freelancers or independent contractors.

Frequently Asked Questions About Weekly Payroll

1. Is weekly payroll better than bi-weekly payroll? Weekly payroll is advantageous for employees who prefer frequent payments, as it improves cash flow and creates a predictable routine. A weekly payroll schedule can also simplify payroll processes for administrators and reduce discrepancies in pay calculations. However, bi-weekly payroll may be more cost-effective for businesses due to reduced administrative workload.

2. How do you manage taxes with weekly payroll? Employers must withhold and report taxes for each weekly payroll period, following federal, state, and local tax regulations.

3. Can small businesses use weekly payroll? Yes, small businesses can offer weekly payroll, though they may benefit from using payroll software to automate the process and reduce the administrative burden.

Related Terms

Revolutionize your Payroll & Empower your People

Get access to the definitive guide on web3-enabled payroll and compliance solutions