The advent of Web3 has revolutionized many aspects of our digital interactions, not least of which is the way businesses handle payroll. With the rise of decentralized autonomous organizations (DAOs) and startups operating within the Web3 framework, new challenges and opportunities have emerged, particularly in the realm of crypto payroll. This blog post delves into the unique hurdles faced by entities in Web3 when dealing with crypto payroll, exploring solutions to these challenges and the evolving landscape of regulatory compliance.

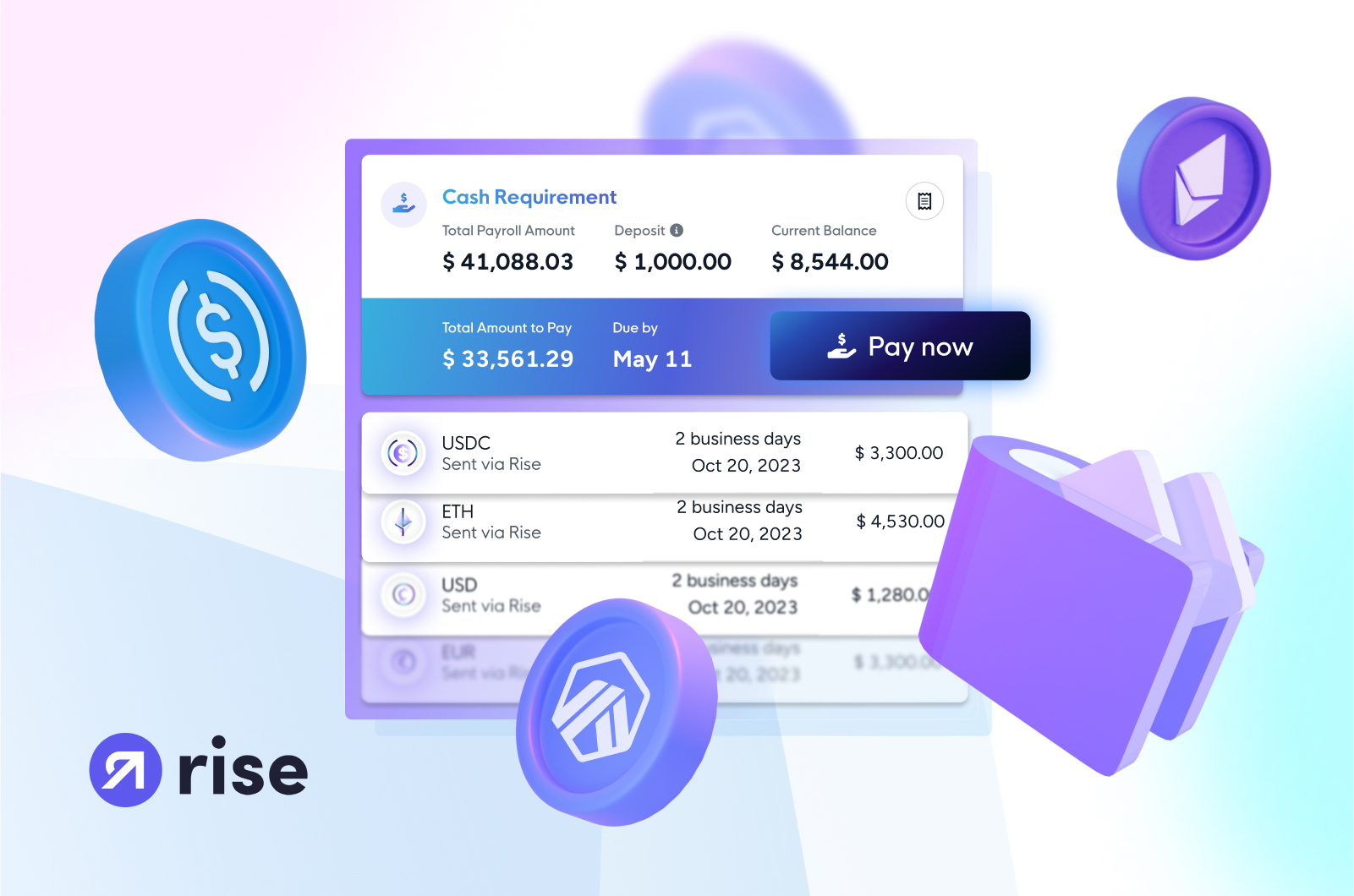

While the diverse nature of the projects being built in web3 means unique treatment for certain issues, when it comes to payroll, many of the same challenges are shared between DAOs and startups. The principal barrier to web3 payroll is lack of access to providers that can ensure compliant compensation in crypto. While the desire to receive and send wages in crypto and stablecoins is there, relatively few options exist for scalable, flexible, and compliant hybrid payroll.

Payments in Crypto

As was mentioned earlier, many web3 startups and DAOs operate using crypto, with the majority of their treasury held in a combination of digital assets. In a study conducted by Chainalysis, for example, it was found that 85% of DAOs hold their treasuries in a single crypto asset. Having the ability to instantly and compliantly issue wage payments to workers in digital assets is thus a must for effectively implementing a scalable payroll system. The alternative, which involves converting crypto into fiat and sending wages from a traditional bank account via wire transfers and direct deposits is not only cumbersome and costly but in the case of DAOs, violates a contributor’s right to privacy.

Another challenge faced by projects with on-chain treasuries is the inability to offer fiat compensation to their workers. While many people working in the web3 sector are eager to receive a paycheck at least partially in crypto, the need for fiat cash to cover real-world expenses cannot be ignored. While some web3 projects are deterred by the very real fear of having their bank accounts frozen due to their work in crypto, others neglect offering fiat options because of the slow and costly nature of converting from crypto to fiat. A solution that supports an on-chain treasury while enabling off-chain fiat payments thus seamlessly bridges the web2 to web3 gap.

Token Compensation

The merits of hybrid payroll versus token compensation have arisen as a hotly debated discourse. At the end of the day, the decision for one over the other is highly dependent on the nature of the project, the predominant currency of the treasury, and the interests of the contributors. For those that opt for tokenized compensation, the need for a web3-friendly payroll service is critical. Determining the value of the tokens, ensuring compliance, and handling tax implications poses unique challenges.

On the whole, due to crypto’s volatility, token compensation is met with the issue of a token’s value fluctuating. This can result in monthly wages, especially in the case of flat-rate salary payments pegged to a value in USD, ranging greatly month by month.

When looked at from through a regulatory lens, a new set of issues arise. California's labor laws, for instance, demand wages to be “payable in cash, on-demand, without discount.” Given the notorious volatility of cryptocurrencies like Bitcoin, token compensation could stumble into legal hot water. Imagine a scenario where an employee is poised to pocket their paycheck in Ethereum, but a market tempest sends Ethereum's price plummeting between payroll processing and payment receipt. This could catapult a company into a legal whirlpool of unpaid wage claims.

Regulatory Ambiguity

The regulatory landscape for crypto and DeFi is continually evolving. Countries such as Argentina, once known as crypto havens, have begun to crack down on transactions, and governments across the EU are enforcing stricter regulatory measures. As jurisdictions call into question their current frameworks governing digital assets, understanding the most relevant regulations becomes confusing and the risk of a noncompliance misstep intensifies.

In Japan, for example, where crypto crackdowns have surged in recent years, a 56-year-old man who evaded paying taxes on his crypto investments was sentenced to a year in prison and a fine of $20,000. Crypto businesses and investors based in Portugal have had to adapt to equally unprecedented changes in the face of the government’s newly enforced strict treatment of digital assets.

In the past, there was zero taxation on an individual’s crypto profits. Beginning in the 2023 tax year, however, a tax is now levied on crypto that is acquired and sold within 365 days. Capital Gains on these transactions are subject to a 28% tax rate- a hard hit for those who based their operations in Portugal due to its original 0% rate of taxation.

Decentralization's Impact on Payroll

Determining the employment status of contributors- whether they are employees, contractors, or community members- is oftentimes nuanced in the web3 space. As was previously mentioned, employment status will change one’s tax classification, which, in the case of employees and contractors, represents a difference in a company’s responsibilities.

While collective decision making has many advantages, a difficulty can arise when making higher-level determinations about an individual’s role in a project and their corresponding status and pay. In the context of DAOs, every DAO has their own mechanism by which decisions are made.

For many, when allocating projects, bounties are used. Scope of work and reward amount are encoded into a smart contract, and members of the DAO community can choose to undertake the outlined task. Once finished according to the specified conditions, evidence of completion is submitted, and after it has been approved, the automatic distribution of funds to a digital wallet is triggered through the smart contract.

On a smaller scale, this process is relatively straightforward and in the days of little to no regulation in the web3 space, reporting was less meticulous. A challenge that DAOs are running into now is leveraging this same system of bounties on a larger scale while ensuring that no labor and tax laws are violated. Depending on the currency in which bounties are issued, in order to properly report for taxation, the fair market value of the crypto at the moment of its receipt must be recorded. For a larger project issuing a multitude of daily and weekly bounties, this process of reporting quickly becomes convoluted and difficult to track.

The journey through the complexities of crypto payroll in the Web3 era underscores the delicate balance between innovation and compliance. As we navigate these uncharted waters, the need for comprehensive guidance and practical solutions becomes ever more crucial. To delve deeper into mastering these challenges and uncovering the vast opportunities that hybrid payroll systems offer, we invite you to download our essential resource, "Payroll Revolution: A Web3 Guide to Global Workforce Payments in Fiat and Crypto."

This eBook is your gateway to understanding the intricacies of payroll and compliance in the Web3 landscape. Whether you're evaluating software vendors, seeking the most effective features in a payroll system, or looking for strategies to overcome the hurdles of crypto payroll, our guide provides the insights and tools you need. Equip yourself with the knowledge to navigate the Web3 world confidently. Download "Payroll Revolution" now and take the first step towards revolutionizing your approach to global workforce payments.

.jpg)

-6Nov2023.jpg)