Portugal stands out amongst EU countries as a hotbed for growth and innovation. In 2022, the country’s GDP growth was projected to reach 6.3%, and in that same year it ranked number 8 for FDI project destinations in the EU.

Portugal has gained additional prominence over the years as a destination for the global crypto community. It has earned itself a reputation for being crypto-friendly, thanks to its progressive approach towards cryptocurrency regulations and its welcoming stance towards blockchain technology. The country's favorable tax policies and initiatives to attract blockchain startups have positioned it as an attractive destination for crypto enthusiasts and businesses alike.

As this reputation has grown, Portugal has attracted crypto traders and digital nomads en masse. The Minister of Labour of Portugal has welcomed these populations with open arms, stating that digital nomads play a fundamental role in the country’s economic development. In 2022, the Portugal D7 Visa for Digital Nomads was created to further attract remote workers. And while many of these digital nomads have sought out Portugal due to its reputation as a relative crypto tax haven, the country has begun to propose stricter regulations for the 2023 tax year.

These regulations will affect both individuals and corporate entities holding crypto. For the 2023 tax year and beyond, ensuring tax compliance on crypto transactions is more important than ever before.

Overview of Portugal’s Crypto Taxation

In the past, there was zero taxation on an individual’s crypto profits. Beginning in the 2023 tax year, a tax will be levied on crypto that is acquired and sold within 365 days. Capital Gains on these transactions will be subject to a 28% tax rate. This, however, will not affect the tax-free nature of crypto that is held for 365 days or more.

When is Crypto Tax Free:

- Crypto that is sold 365 days or more after its initial acquisition

- Crypto is not subject to VAT

When is Crypto Taxed:

- Crypto profits made by companies registered in Portugal

- Crypto income made by anyone the Portuguese government considers to be a professional trader

- Starting in the 2023 tax year, crypto that is acquired and sold in less than 365-day period

Crypto Taxes for Businesses in Portugal

Companies based in Portugal that deal in crypto or that hold crypto assets are obligated to pay income taxes on any profits generated from their crypto transactions. The rates of taxation will range from 28%-35%.

For Portuguese companies, if employees or contractors are compensated in crypto, taxes will also be owed on wage payments. When crypto is used as payment for a product or a service, an invoice must be issued and taxes must be paid accordingly.

Paying Contractors in Crypto with Rise

For companies based in Portugal holding crypto or remunerating contractors in crypto, it is more important than ever before to stay up to date on the country’s ever-changing legal landscape.

Portugal still upholds its reputation as being crypto friendly, especially in respect to other EU countries that have cracked down with continuously harsher crypto regulations. With new tax laws put in place for 2023, however, it is highly likely that this current wave of regulation will bring further changes in the years to come.

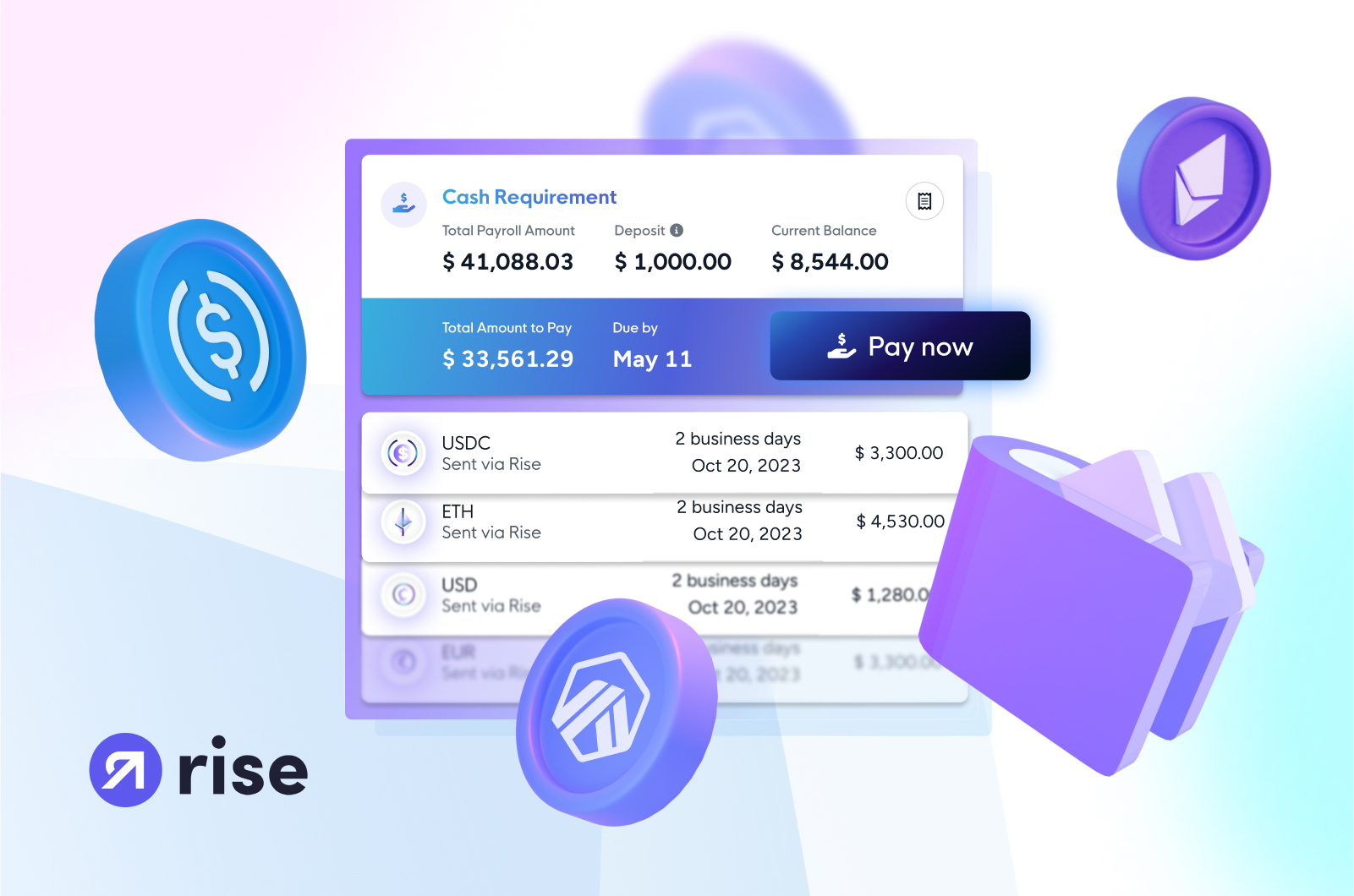

Rise provides an all-in-one payroll and compliance solution for web3-native organizations and traditional companies alike. At present, Rise supports 90 local currencies and 100 cryptocurrencies. Whether you hold your treasury in fiat or crypto, in a bank account or digital wallet, Rise has an option for automating and streamlining your payroll.

Onboard contractors, generate professional service agreements in minutes, automate instant payouts and guarantee total compliance with Rise. While Portugal’s legal landscape may be in flux, Rise takes care of the crypto compliance so that you don’t have to.

Get started today with crypto payroll and compliance with Rise.