France has joined the ranks of international governing bodies adopting more stringent regulations for crypto. In 2023 the French tax authority, the DGFiP, put into law a new regulatory framework cracking down on crypto transactions and governing its taxation.

Yet as the French government continues to propose increasingly severe regulatory measures, the interest in crypto amongst the French populace steadily rises. Over the past year, crypto ownership has grown by 1.7%, with France now boasting 3.4 million individuals invested in crypto.

Staying up-to-date on the latest legislation governing crypto’s taxation is more important than ever before as the DGFiP threatens closer monitoring of crypto activity and severe penalties for noncompliance.

Overview of the Taxation of Crypto in France

For tax purposes the DGFiP treats crypto equivalent to movable property. This means that like property, when crypto is sold or traded for fiat currency, income tax is owed on any resulting gains.

The determining factor that impacts the tax liability arising from an individual’s crypto transactions lies in the distinction made by the French government between occasional traders and professional traders.

An occasional trader is someone who exclusively manages their personal crypto portfolio, regardless of how much their investments amount to in a given fiscal year. They are responsible for paying the Prélèvement Forfaitaire Unique, a flat-rate tax of 30% applied to profits made on financial investments.

The PFU affects movable income and capital gains and is broken down into income tax, which makes up 12.8% and social security contributions which amount to 17.2%.

The secondary category, the professional trader, is far less common. Professional investors are those who the DGFiP classify as executing professional crypto transactions as a business practice on a regular basis. In this scenario, capital gains from the sale of crypto are taxed as industrial and commercial profits (BIC).

For individuals who receive remuneration for goods or services in crypto, these wages should be treated as income and thus taxed under the progressive income tax rates with the addition of social security contributions.

Taxable Crypto Transactions

- Selling crypto for fiat currency

- Crypto used to purchase goods or services

- Crypto received in exchange for goods or services

Non-Taxable Crypto Transactions

- Capital gains on crypto that do not exceed €305 in a fiscal year

- Trading crypto for crypto

- Buying crypto with euros or other fiat currencies

- Holding crypto

- Transfering crypto between personal wallets

Tax on Crypto for Occasional Traders

For those who the DGFiP classifies as occasional traders, there are two options for paying taxes on crypto. The standard flat-rate PFU of 30% can be levied on crypto profits above €305, or, depending on an individual's total yearly income, the social security contribution can be paid while the income tax of 12.8% is waived in favor of the progressive income tax rates.

This scenario favors individuals with annual earnings below €10,778 as they are subject to a reduced income tax rate of 11%.

Additionally, occasional traders have the option to reduce their tax burden by offsetting capital gains with crypto losses. These capital losses cannot, however, be carried forward into future years; they are only applicable within the fiscal year in which they are incurred.

Tax on Crypto for Professional Traders

For professional traders, or those who are executing high volumes of crypto transactions, taxation is based on the BIC tax regime and reporting. Depending on the profits made in capital gains, this tax rate can be as high as 45%.

Corporate Taxes on Crypto

For companies paying contractors or employees in crypto, in accordance with France’s new legal framework which taxes the remuneration of goods or services in crypto, taxes must be withheld on wages.

Withholdings for employees and contractors can be calculated by determining the fair market value of the crypto in euros upon payment.

Additionally, all transactions executed in crypto must be reported for accurate tax calculations at the end of the fiscal year.

Paying Contractors in Crypto with Rise

In France, the treatment of noncompliance is severe. Penalties include up to €1,500 per unreported account and €250 for every omission or error in reporting. For employers who misreport employee wages, fines reach €2,000 per-employee. In extreme cases, noncompliance can be punishable by up to five years imprisonment.

In order to avoid costly repercussions, French organizations that pay contractors in crypto must stay up-to-date on the ever-changing legislature around crypto tax compliance.

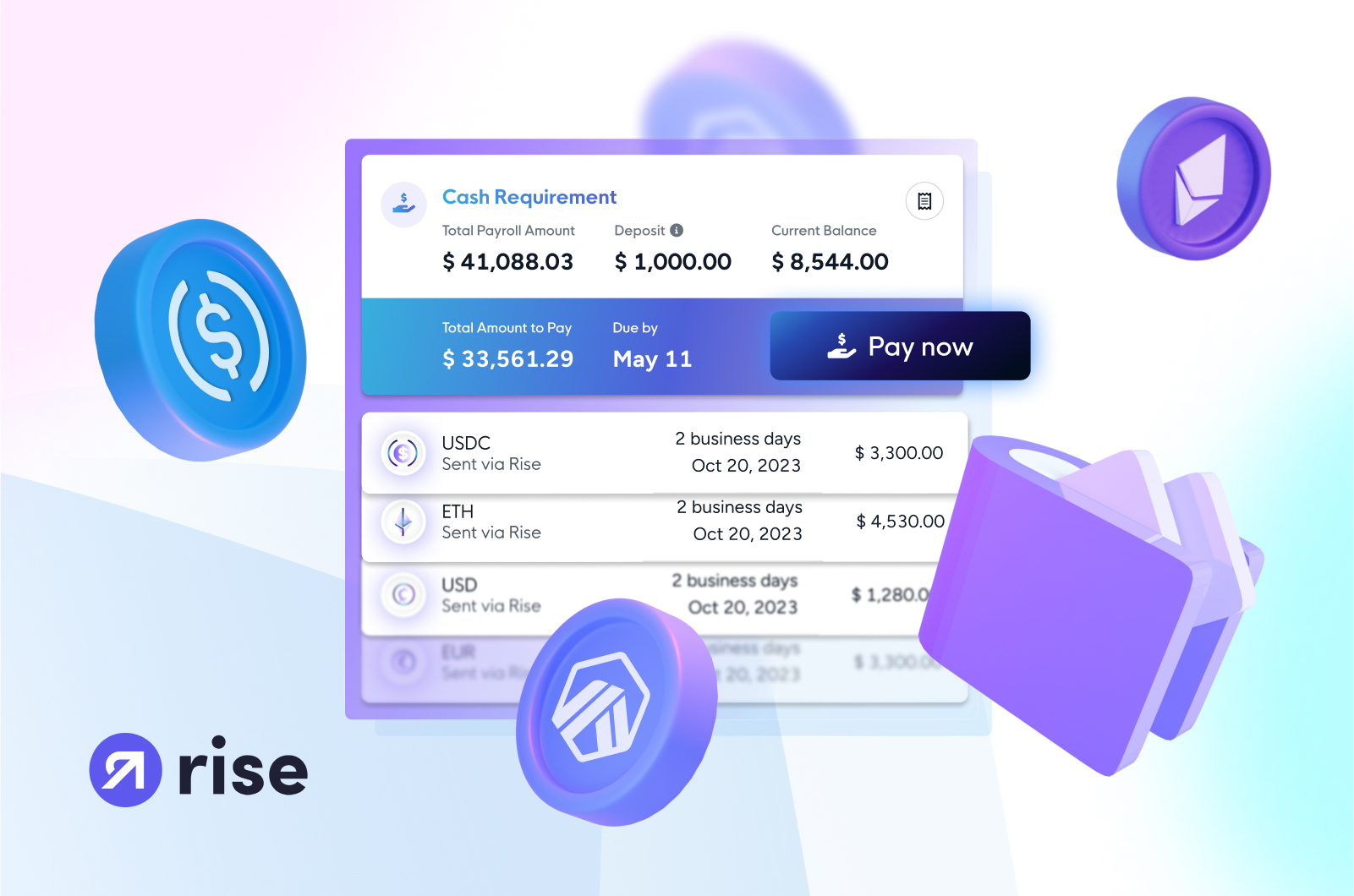

Rise provides an all-in-one solution for streamlining crypto payroll and compliance. For French-based companies offering crypto, fiat, or mixed payroll, Rise offers global crypto and fiat payroll and guaranteed total compliance.

With Rise’s flexible routing infrastructure, organizations can fund payroll in crypto and contractors can receive payouts in fiat, or vice versa. Regardless of the currency in which you choose to send payments, Rise ensures full local and global compliance.

Drive your organization’s growth with automated onboarding, payroll, and compliance with Rise. Schedule a demo today to learn how you can optimize your operational performance.